Here’s a look at the divergence in the Dow, Nasdaq over the past month

Paul Hickey, co-founder of Bespoke Investment Group, joined “Squawk Box” on Monday to discuss the divergence in the Dow and the Nasdaq over the last month as well as where he thinks the markets are headed as the first quarter of 2021 comes to a close. For access to live and exclusive video from CNBC subscribe to CNBC PRO: https://cnb.cx/2NGeIvi

The Nasdaq Composite led the S&P 500 higher on Monday amid falling Treasury yields as Wall Street looked to bounce back from a losing week.

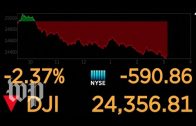

The tech-heavy benchmark gained 0.6% as the 10-year yield retreated. The S&P 500 rose 0.2%. The Dow Jones Industrial Average declined 65 points.

The 10-year Treasury yield fell 5 basis points to 1.68%, after touching a 14-month high last week (1 basis point equals 0.01%). The move higher in rates has raised concerns about valuations on growth and tech stocks.

Shares of Tesla added more than 5% as rates fell and as Cathie Wood’s Ark Invest put out a new price target on the stock which calls for it to quadruple in four years.

The three major indexes lost ground last week. The Dow and S&P 500 slipped on Friday to finish the week down 0.5% and 0.8%, respectively, breaking two-week winning streaks. The Nasdaq Composite rose on Friday but still finished the week with a 0.8% loss.

The struggles for stocks came as bond yields jumped again last week, pressuring the tech and growth stocks that led the market back from its pandemic-sparked sell-off last year.

Even with the weakness last week, the S&P 500 and Dow are still near record highs, and the Nasdaq isn’t too far off. Darrell Cronk, chief investment officer of Wells Fargo’s Wealth and Investment Management, said the stock market still appeared to be on track for a multi-year climb.

“If you went down the list and started putting boxes of check-check-check-check, you would look at this in a vacuum … and say it looks like an early recovery cycle that’s roughly a year in that probably has a number of years yet to run,” Cronk said.

Optimism about the markets and the path of the U.S. economy has been growing as vaccines are rolling out across the country, with the pace of Americans getting shots climbing in recent weeks. Several states are seeing an increase in Covid-19 cases, however.

U.S. trial data released Monday showed the Covid vaccine developed by AstraZeneca and the University of Oxford is 79% effective in preventing symptomatic illness and 100% effective against severe disease and hospitalization.

Over the weekend, the industrials sector produced a major piece of corporate news. Canadian Pacific Railway announced that it was buying Kansas City Southern in a deal valued at $25 billion, creating a rail giant that connects, Canada, the U.S. and Mexico.

» Subscribe to CNBC TV: https://cnb.cx/SubscribeCNBCtelevision

» Subscribe to CNBC: https://cnb.cx/SubscribeCNBC

» Subscribe to CNBC Classic: https://cnb.cx/SubscribeCNBCclassic

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

The News with Shepard Smith is CNBC’s daily news podcast providing deep, non-partisan coverage and perspective on the day’s most important stories. Available to listen by 8:30pm ET / 5:30pm PT daily beginning September 30: https://www.cnbc.com/2020/09/29/the-news-with-shepard-smith-podcast.html?__source=youtube%7Cshepsmith%7Cpodcast

Connect with CNBC News Online

Get the latest news: http://www.cnbc.com/

Follow CNBC on LinkedIn: https://cnb.cx/LinkedInCNBC

Follow CNBC News on Facebook: https://cnb.cx/LikeCNBC

Follow CNBC News on Twitter: https://cnb.cx/FollowCNBC

Follow CNBC News on Instagram: https://cnb.cx/InstagramCNBC

https://www.cnbc.com/select/best-credit-cards/

#CNBC

#CNBCTV